Loading content...

- Software DevelopmentIT Consulting & DesignAI & Data SolutionsQuality AssuranceTeam & Resource SupportBusiness Support Services

A streaming payments engine flags an anomalous wire transfer, scores it as high-risk in milliseconds, and routes it to a human analyst—preventing losses and retaining premium clients. This blog explores how AI-augmented .NET development empowers fintech firms to reduce fraud, accelerate development, and deliver regulatory-compliant, real-time solutions.

Integrates ML.NET, ONNX Runtime, and Azure AI to detect fraud and automate decisions in real time.

Enforces compliance, data encryption, secure APIs, and role-based access control for sensitive financial data.

Optimized .NET pipelines handle thousands of transactions per second with sub-100ms response times.

Loading content...

Let's discuss your project and create a custom web application that drives your business forward. Get started with a free consultation today.

A streaming payments engine flags an anomalous wire transfer, a real-time model scores it as high-risk, and within 200 milliseconds, the system routes the transaction to a human analyst—preventing a six-figure loss and retaining a premium client.

This kind of rapid, data-driven response is now table stakes for modern finance. Financial firms embedding AI-augmented .NET development into their core applications are moving faster, safer, and more profitably. According to research, AI augmentation can cut development time by up to 40%, while reducing fraud losses by 30% and increasing customer retention by 25%.

The challenge: how do fintech teams merge the speed and scalability of .NET with auditable, regulatory-compliant AI?

This blog delivers:

AI-augmented .NET development uses AI-powered models and smart tools at every stage of your application's life cycle, from finding bugs and scoring credit to customizing the experience for each customer and automating tasks.

Real-time prevention protects income, lowers the cost of fixing problems, and builds trust with customers. Some institutions say that AI-driven detection has cut their fraud rates by as much as 30% from one year to the next.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

public class TransactionInput {

public float Amount { get; set; }

public float HourOfDay { get; set; }

public float DaysSinceAccountOpen { get; set; }

public float MerchantRiskScore { get; set; }

}

public class TransactionPrediction {

public bool PredictedLabel { get; set; }

public float Score { get; set; }

public float Probability { get; set; }

}

public class FraudScorer {

private readonly MLContext _mlContext = new MLContext();

private readonly PredictionEngine<TransactionInput, TransactionPrediction> _predictor;

public FraudScorer(string modelPath) {

ITransformer model = _mlContext.Model.Load(modelPath, out var schema);

_predictor = _mlContext.Model.CreatePredictionEngine<TransactionInput, TransactionPrediction>(model);

}

public TransactionPrediction Score(TransactionInput input) => _predictor.Predict(input);

}

// Usage

var scorer = new FraudScorer("fraudModel.zip");

var result = scorer.Score(new TransactionInput { Amount = 1200f, HourOfDay = 2f, DaysSinceAccountOpen = 45f, MerchantRiskScore = 0.75f });

Console.WriteLine($"Fraud: {result.PredictedLabel}, Prob: {result.Probability}");

A mid-sized payments processor faced a significant increase in fraudulent transactions during peak seasons. Their manual review processes delayed approvals, which led to lost revenue opportunities and frustration for legitimate customers

The team implemented an AI-augmented .NET platform for real-time fraud detection. Key components of the solution included:

ML.NET and ONNX Runtime for high-performance, low-latency scoring.

Azure Event Hubs to handle high-volume, real-time transaction ingestion.

SignalR dashboards for real-time analyst visibility and actionable alerts.

Achieved a 28% reduction in fraud-related losses within six months.

Reduced approval processing times from 8 minutes to approximately 40 seconds.

Automated model retraining pipelines to seamlessly monitor and address model drift.

"The AI-first .NET approach gave us a secure, scalable, and high-performing fraud detection pipeline without requiring a disruptive overhaul of our existing systems."

A robust architecture ensures that your AI-augmented .NET solutions are scalable, secure, and efficient. Below is the reference stack typically used for modern fintech implementations:

| Layer | Tools & Technologies | Purpose / Key Role |

|---|---|---|

| API Layer | ASP.NET Core | Makes APIs that are fast, safe, and able to grow to work with client apps, partners, or internal systems. |

| Data Layer | Entity Framework (EF) Core | ORM makes it easier to work with databases while keeping data consistent and fast. |

| Real-Time | SignalR | Enables real-time communication for features like fraud alerts, dashboards, and instant notifications. |

| AI/ML Layer | ML.NET, ONNX Runtime, Azure ML | Supports model training, optimization, and inference at scale — with seamless integration into .NET services. |

| Streaming Layer | Event Hubs, Kafka | Handles large-scale, low-latency data streams such as transaction events or risk-scoring pipelines. |

| Monitoring & Observability | Application Insights, OpenTelemetry | Provides detailed logging, performance tracking, and system observability for debugging and auditing. |

| Deployment Layer | Docker, Kubernetes (AKS) | Ensures containerized, scalable deployments with high availability and efficient resource utilization. |

| CI/CD Pipeline | Azure DevOps, GitHub Actions | Automates the pipelines for building, testing, and deploying software, which speeds up and makes release cycles more reliable. |

| Step | Estimated Duration | What to Do ? | Key Deliverables |

|---|---|---|---|

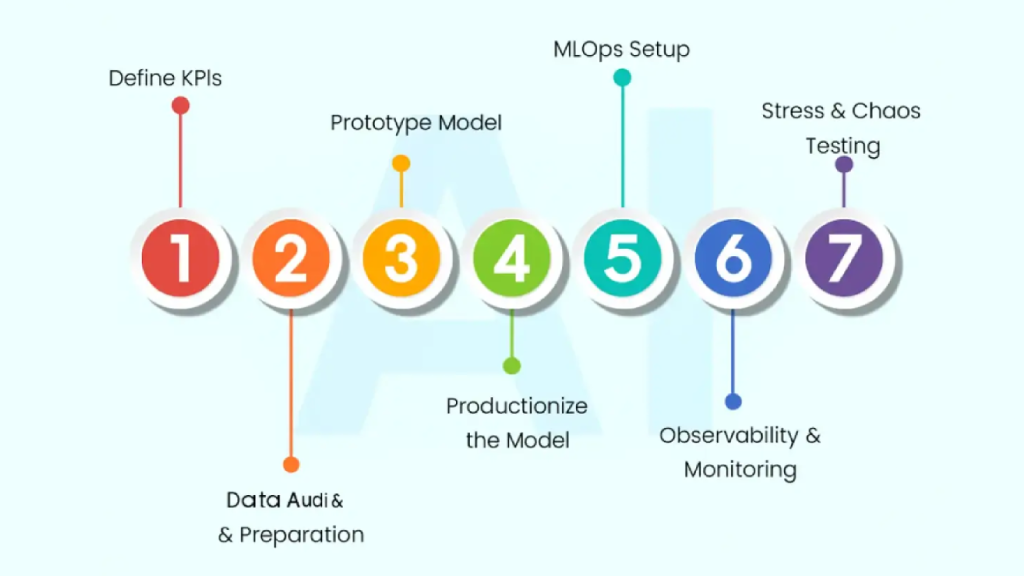

| Define KPIs | ~2 weeks | Determine precise success metrics that are connected to business objectives, like a decrease in fraud, a quicker approval process, or a reduction in operating expenses. | Documented KPI framework with measurable benchmarks. |

| Data Audit & Preparation | 2–4 weeks | Verify quality, audit all data sources, make sure labels are correct, and evaluate compliance readiness (GDPR, PCI DSS). | Clean, validated, and labeled datasets ready for modeling. |

| Prototype Model | 4–8 weeks | To confirm viability, create a baseline model in Python or ML.NET. Pay attention to proof of value and speed to market. | MVP model with initial evaluation report and accuracy metrics. |

| Productionize the Model | 4–6 weeks | Use the ONNX Runtime to optimize for low-latency inference, put APIs into place, and containerize for scalability. | Optimized model deployed in a test environment. |

| MLOps Setup | 2–4 weeks | For reliability and governance, put in place automated retraining workflows, model versioning, and CI/CD pipelines. | Automated build, test, and deployment pipelines for code and models. |

| Observability & Monitoring | Ongoing | Establish real-time tracking for explainability, performance metrics, and drift detection. | Monitoring dashboards, alerts, and logging pipelines. |

| Stress & Chaos Testing | ~2 weeks | Simulate peak load and failure scenarios to validate resilience, latency, and recovery processes. | Stress testing reports and tuning recommendations. |

| Area | Why It Matters | How to Implement | Pro Tip |

|---|---|---|---|

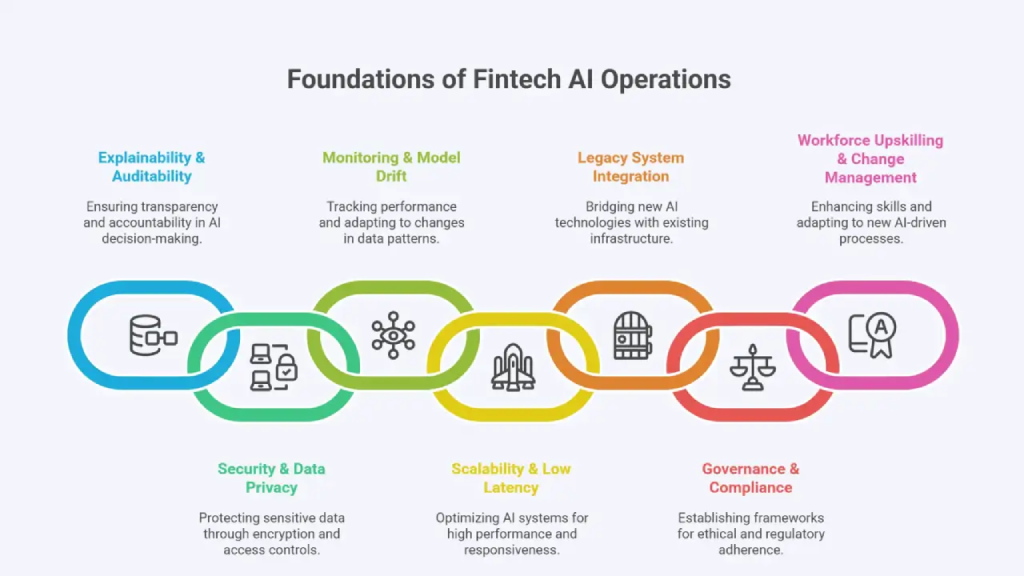

| 🔍 Explainability & Auditability | Regulatory frameworks like PCI DSS, GDPR, and Basel demand transparency. Every AI-driven decision in fraud detection or credit scoring must be explainable. | - Use ML.NET Explainability APIs or SHAP for feature importance. - Log predictions with input features, model version, and decision rationale. - Store explainability logs in secure, searchable systems. | Build compliance dashboards so non-technical teams can visualize decision paths. |

| 🔐 Security & Data Privacy | AI relies on sensitive financial and personal data. A breach risks penalties and erodes trust. | - Encrypt data at rest (SQL TDE, Azure Key Vault) and in transit (TLS 1.2+). - Tokenize or anonymize PII before processing. - Use RBAC to control access. - Leverage confidential computing for high-security environments. | Conduct regular penetration tests and update security protocols with every release. |

| 📊 Monitoring & Model Drift | Models degrade over time as fraud patterns and customer behavior change, leading to inaccuracies. | - Continuously monitor input/output distributions and accuracy. - Set up automated alerts for performance drops. - Automate retraining pipelines with version control. - Maintain rollback options for previous models. | Pair automated drift detection with periodic human reviews for critical systems. |

| ⚡ Scalability & Low Latency | Real-time fintech apps handle thousands of transactions per second. Delays can cost revenue and reputation. | - Use ONNX Runtime for high-speed inference. - Deploy models on AKS or Azure Container Apps for auto-scaling. - Cache static data to reduce processing load. - Regularly profile and benchmark applications. | Target sub-100ms latency for fraud scoring and similar real-time use cases. |

| 🔗 Legacy System Integration | Replacing legacy systems at once is risky and costly; gradual integration ensures stability. | - Add an API or messaging bridge between legacy systems and AI pipelines. - Use event-driven architectures like Kafka or Event Hubs. - Decouple services incrementally to migrate safely. | Start with non-critical systems (like reporting) before touching core transaction flows. |

| 📜 Governance & Compliance | Poor governance leads to compliance failures and operational chaos. | - Create a cross-functional AI governance team (compliance, data, IT). - Maintain detailed model registries with version and approval data. - Schedule regular compliance audits. - Use RegTech tools for real-time monitoring. | Treat governance as a continuous process, adapting to evolving regulations. |

| 🎓 Workforce Upskilling & Change Management | Teams need modern skills to manage AI pipelines effectively; lack of training slows adoption. | - Train developers in ML.NET, ONNX, and Azure ML. - Document workflows and create playbooks. - Encourage learning with hackathons and innovation sprints. - Pair junior developers with experienced architects. | Track training adoption rates to identify gaps and plan additional programs. |

AI-augmented .NET development blends enterprise-grade reliability with next-generation analytics, giving fintech companies a faster, safer, and more scalable path to innovation.

Start small with a focused proof-of-concept, ensure data quality and explainability, and iterate toward production-ready deployments. With the right governance and strategy, you can see early ROI in as little as 3–6 months and scale enterprise-wide within a year.

Moltech Solutions Inc. can help you bridge the gap between AI potential and practical implementation—securely, efficiently, and at scale.

Want to see how AI-augmented .NET is transforming fintech?

Book a free chat with Moltech Solutions Inc.—learn how to build real-time, secure, and compliant payment platforms with AI-driven fraud detection, ML.NET, ONNX Runtime, and scalable .NET architectures.

Let's connect and discuss your project. We're here to help bring your vision to life!